Google is looking to acquire a 5% stake in the crisis-hit Vodafone Idea.The troubled telco has debts of nearly ₹1,20,000 crore.Apart from this, it also has non-convertible debentures, which is another form of debt, worth ₹13,276 crore.

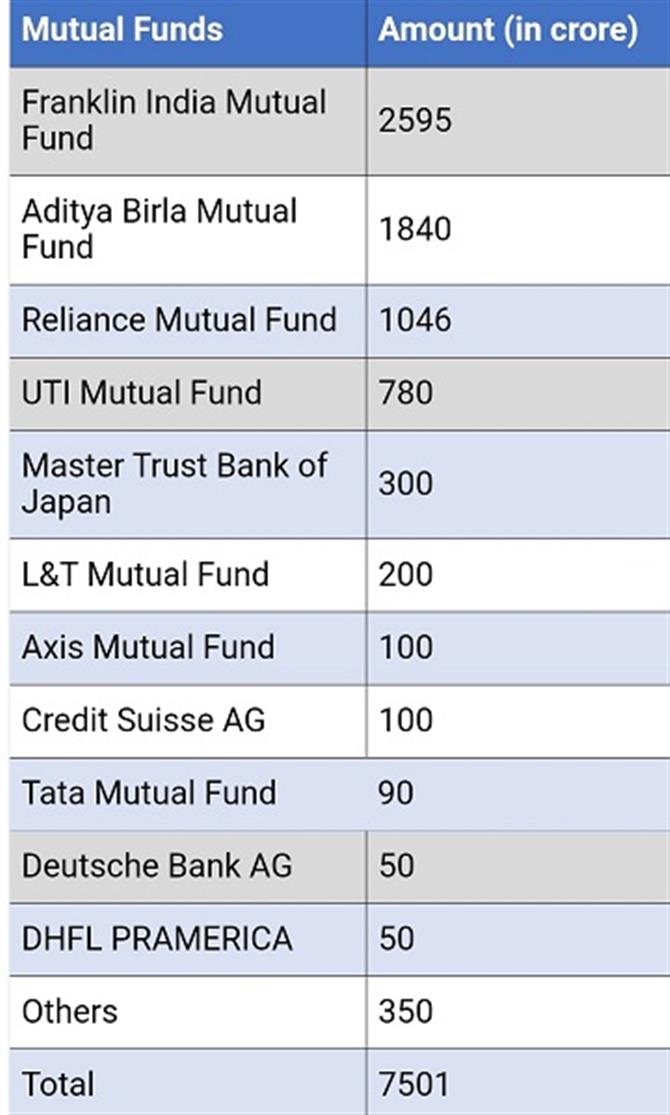

Franklin Templeton, which shut down six funds in April, has the highest exposure at ₹2,595 crore.

Search giant Google is reportedly looking to acquire a 5% stake in Vodafone Idea. While the finer details of the deal are not known yet, several banks and mutual funds are likely waiting for the deal to close.

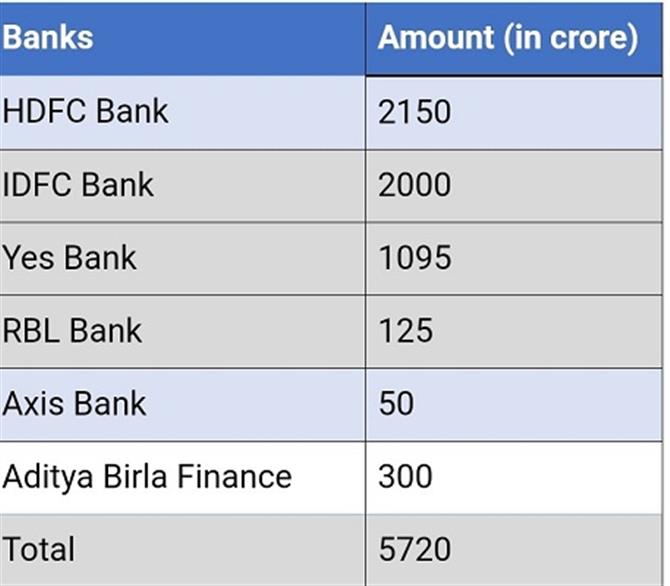

The debt-laden Vodafone Idea had borrowings of ₹1,18,575 crore as of March 31, 2019. Of these, its rupee loans from Yes Bank stood at ₹5,000 crore, while Indusind Bank’s exposure stood at ₹3,000 crore.

Vodafone Idea’s cash and cash equivalents also paint a precarious situation. According to the company’s FY19 financial statements, it had cash and cash equivalents of ₹678 crore, suggesting that it was running on fumes.

To meet its liquidity requirements in the short-term, Vodafone Idea issued new non-convertible debentures (NCDs) worth ₹1,500 crore. Although the details of the subscribers of these NCDs are not known yet, various banks, non-banking financial companies (NBFCs) and mutual funds have hundreds of crores of exposure to Vodafone Idea.

According to the report by Sunidhi research that has data as of March 31, obtained from the Ministry of Corporate Affairs, here’s how much each bank, NBFC and mutual fund is exposed to Vodafone Idea:

Source:Ministry of corporate Affairs

This data is as of March 2020

Interestingly, Franklin Templeton, which has the highest exposure at ₹2,595 crore, had shut down six funds worth ₹30,800 crore earlier in April.

Subsequently, the company’s global chief Jennifer M Johnson pointed out that the adverse ruling against Vodafone Idea in the AGR case ‘created a bit of a run on the funds’.

Vodafone Idea in a statement to NSE has said, "As part of corporate strategy, the company constantly evaluates various opportunities for enhancing the stakeholders’ value. As and when such proposals are considered by the Board of Directors of the Company warranting disclosures.

Vodafone Idea in a statement to NSE has said, "As part of corporate strategy, the company constantly evaluates various opportunities for enhancing the stakeholders’ value. As and when such proposals are considered by the Board of Directors of the Company warranting disclosures, the Company shall comply with the disclosure obligations under the SEBI Regulations. Currently, there is no proposal as reported by the media that is being considered at the Board."